No matter how old you are, or how many years you’ve been part of the workforce, retirement should ALWAYS be on your mind.

It starts with BIG picture thinking.

When you think about retirement, what comes to mind? Imagine it, no more 6am starts, KPI’s, or busy worksites, only beer and BBQ’s!

Perhaps you envision spending extra time with family, taking a yearlong holiday in your caravan, or finally building your dream garden! Regardless of your retirement plans, the world is changing, and so is the future of retirement.

For younger Australians, especially those born after 1980, we expect that retirement will look very different from what their parents or grandparents experienced.

Let’s break it down!

The following article is all about you and your future. Let’s look at how the future of retirement is shaping up and what you can do to prepare.

First things first, what is retirement?

Retirement occurs when an employee decides to stop working permanently, usually after reaching a certain age.

While there is no mandatory retirement age in Australia, most workers decide to retire when they become eligible to receive an Age Pension, which is currently available for Australians aged 67 and older.

But this representation of retirement may not be the norm for much longer!

Prior to the 1990s, workers could afford to exit the workforce around the age of 60-65, however with higher living costs, longer lifespans, and an abundance of career opportunities, more Australians are working longer or are choosing to retire later in life.

To make retirement achievable for Australians, compulsory super, also called the Superannuation Guarantee (SG), was adopted in 1992. From then on, it became a legal requirement for employers to make super contributions on behalf of their employees.

How will the future of retirement look different?

In Australia, the rising cost of living, essential goods, and housing is significantly impacting both the current and future workforce. The average age of home ownership has increased from 25 in 1970 to 36 in 2023. This shift has had a major effect on when people can afford to retire, with many Aussies now needing to work well into their 70s just to pay off their mortgage.

Some Aussies just won’t have enough savings to stop working completely.

In fact, 69% of Gen Z believe they won’t have a choice when it comes to retirement. Many expect they’ll need to continue working beyond the age of 70 to make ends meet.

We are also living longer. So, the current and future workforce should prepare for a longer working life that goes far into their 60s or beyond.

The average lifespan has increased from 68 years in 1960 to 81 years in 2020 (for males), which means there’s more time to build a career that suits your changing lifestyle and goals. However, living longer, healthier lives may have a downside, the Australian government may continue to make further changes to how and when we can access the Age Pension, making it harder to qualify.

More Australians are expected to have multiple income streams to help them prepare for retirement, such as superannuation, second jobs, and property investments.

How can young workers get ready? 4 ways to prepare:

You don’t need to have it all figured out. No matter how far you are in your career, you find a way to make it work.

But there are several things you can do to kickstart, prepare, and plan for your future retirement.

1. Understand Your Super

Superannuation (“super”) is a compulsory retirement system in Australia which was implemented to ensure that individuals have the funds available to support themselves through retirement. Your employer must pay 11.5% on top of your wages into your super fund. You can choose your own or use the employer’s default one, but don’t ignore it.

Stay in the loop:

- Make sure you only have one super fund to avoid paying unnecessary fees.

- Log into your super account regularly to monitor your contributions.

- When you can afford it, add in some extra cash, it adds up!

2. Start Saving

It’s fun (and easy) to spend money, especially when you’re new to the workforce. We get it, having access to your own income stream can feel like true freedom – but it can only go so far.

Making small, regular contributions to a savings account can make a massive difference over time. The earlier you start saving, the more time your money has to accumulate interest.

3. Plan for the life you want

What does the perfect retirement look like to you? – It’s important to know what your goal is.

Whether you’re looking forward to an outback road trip, a coastal beach house, or just want to support your family, it’s important to know what you’re aiming for.

If you’re interested in planning ahead, the MoneySmart Retirement Planner Tool can provide you with an estimate of how much you’ll need to comfortably retire based on your lifestyle and goals.

4. Stay Healthy

To retire comfortably you’ll need more than money. You need your health.

It’s important to stay active, eat well, and take care of your mental health while you’re still young. By staying in shape, you’ll get more out of your older years. Being healthy gives you extra time and energy to enjoy your retirement and will also lower the cost of future medical bills.

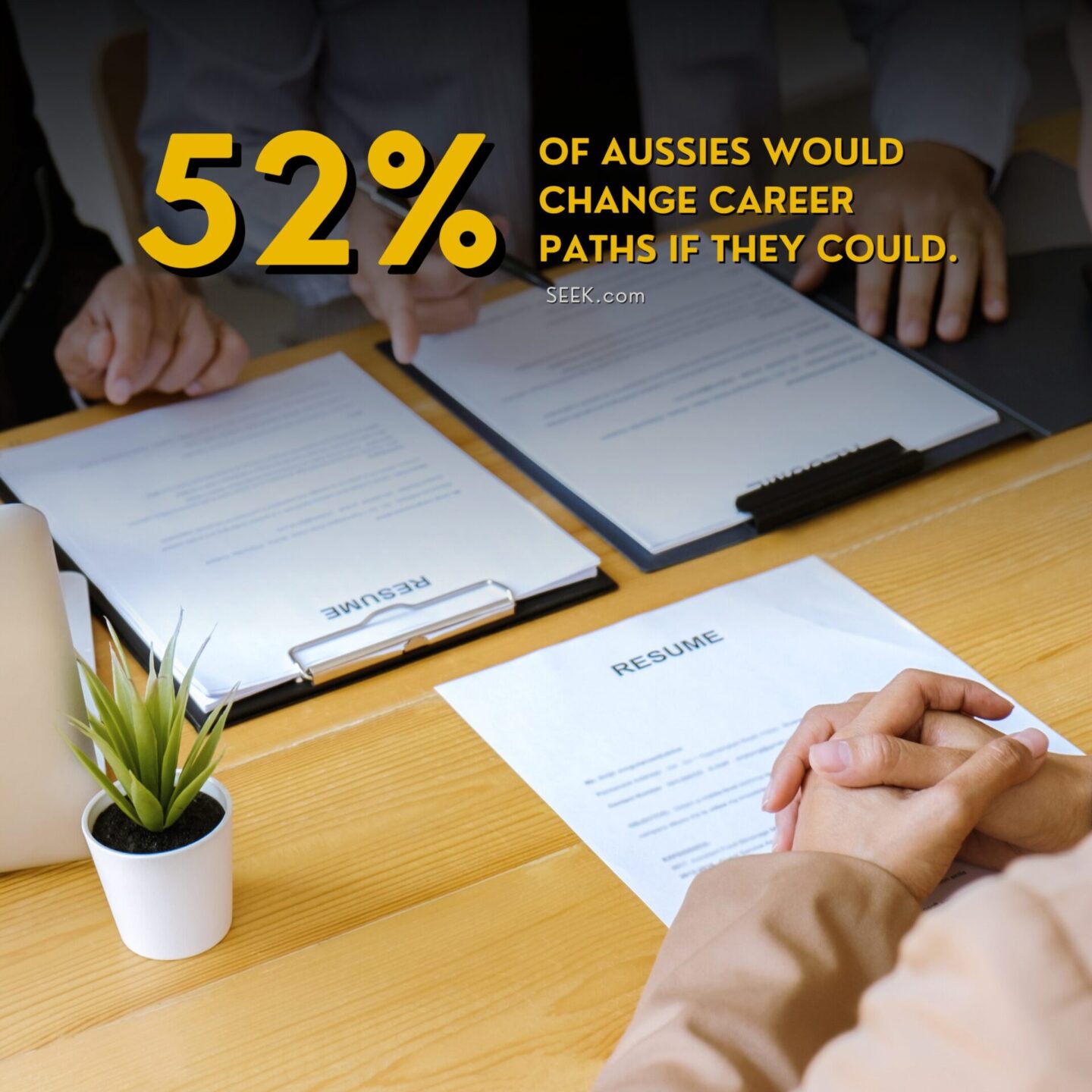

Retirement is exciting, but so is employment! Do you enjoy coming to work?

According to a recent SEEK survey, 52% of Australians would choose a different career path if they had the chance to go back in time.

The good news? It’s never too late to make a change and pursue something more fulfilling.

The average Australian will spend 90,000 hours at work. Retirement might seem like a lifetime away, but the earlier you start planning, the more freedom you’ll have later in life.

Work with our recruiters to get more out of the job search.

Job searching is stressful. But you shouldn’t feel the need to tackle it alone. It costs $0 to consult with a recruiter at Staff Australia.

Working with a recruiter can make all the difference in your job search. If you are on the hunt for your next role, we encourage you to explore our job listings or call 1300 178 233 to find out more.